12 years have passed since the last crisis and many of us have already forgotten about this difficult time.

Short reminder how it was:

https://www.youtube.com/watch?v=l1DBDONn9wQ

First of all: don't panic!

It is said that emotions are not the best advisor. This is particularly important when buying electricity and natural gas. In a crisis situation, when energy markets are raging, it is very difficult to make the right purchasing decisions. Should we still wait? Should we order further analyzes, order new reports? Do we need even more data? Buy tranches now? For next quarter, a year even further ahead, or maybe leave your prices on spot quotes?

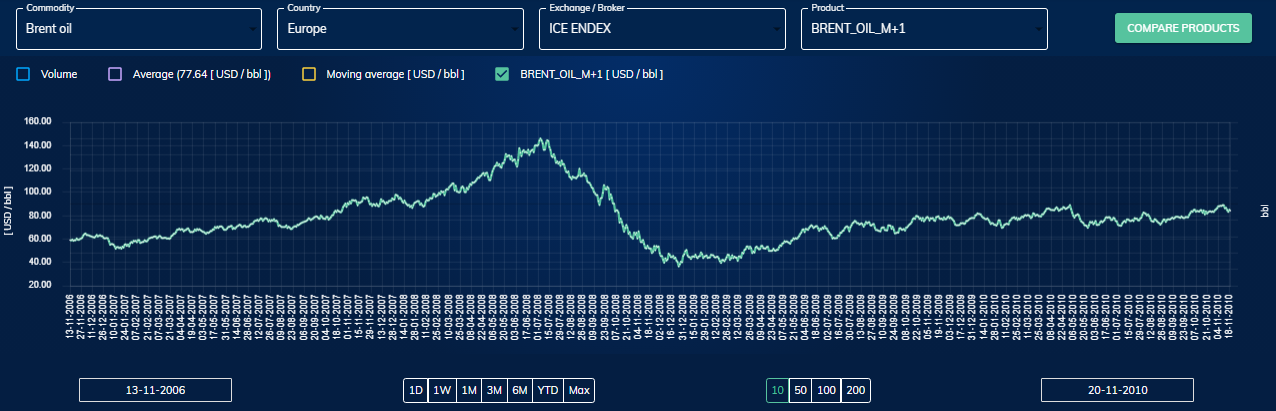

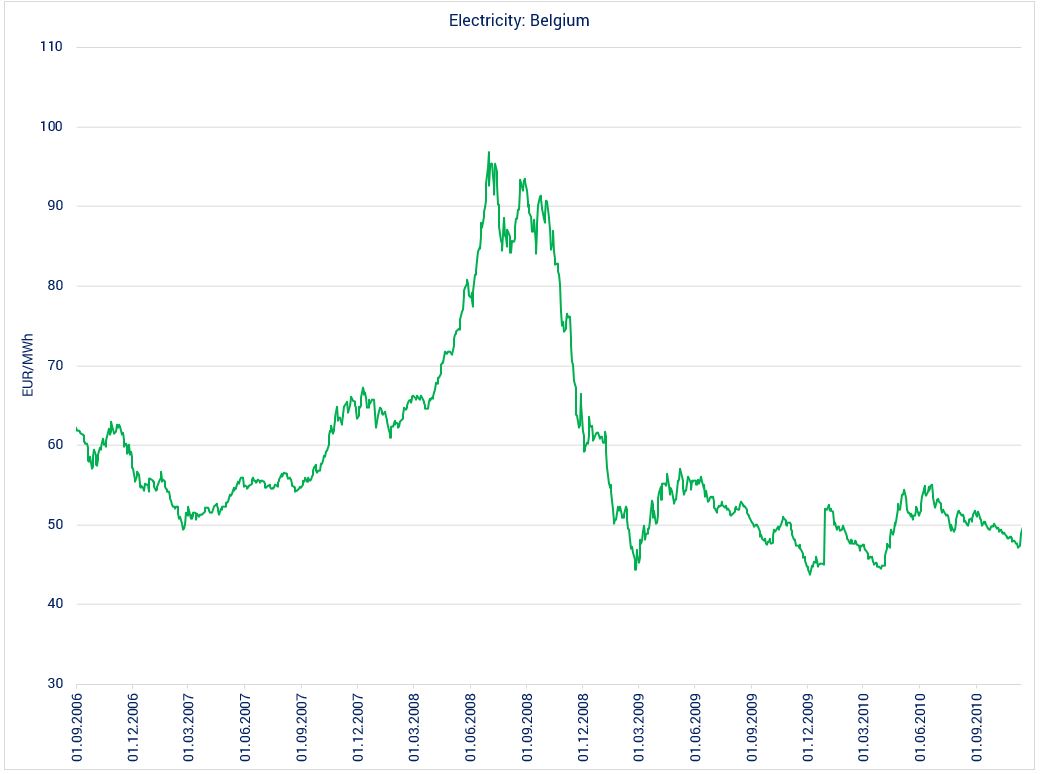

The Energy Information Administration (EIA) reported that in 2020 oil demand will not rise for the first time since 2009, and the coronavirus pandemic is still affecting its further decline in demand. There has been talk for a long time about the coming economic slowdown. Will the COVID-19 situation contribute to the recession in 2020? Perhaps, then, let's look at the impact that the economic crisis of over 10 years ago had on energy markets.

Oil drops from $ 140 a barrel to $ 40 in less than six months:

What to do?

1. Prevention is better than cure

When do we usually panic? When the situation surprises us and we are not prepared for it. How to work Whom do you listen to? It is worth having prepared the scenarios well in advance, and in a crisis situation we should only react in accordance with the adopted rules.

The crisis of 2008 is a distant situation. Let's look at 2018 and remember the severe price increases. It gives food for thought in the context of our energy purchases. What didn't work then? What should we do differently so that in the future we can safely go through a possible repetition of such events? It is impossible to completely eliminate market risk, but significant minimization of exposure to it is already possible. A well-chosen long-term risk management strategy will definitely help in difficult times. Let us remember that contracts, strategies and tactics are prepared for bad and not for good times. However, a static strategy is not enough. With dynamically changing markets, political decisions and the fight against climate, the strategy should be updated. How often? It depends on the pace of changes in the market and geopolitical environment. Once there was no talk about Corporate Power Purchase Agreements (PPA), purchasing green energy, 100% CO2 neutrality. Today is daily bread. The energy market is changing, paradigms in energy purchases are changing.

2. First measure then act.

The proper contract for electricity or natural gas is always needed. In the era of current events caused by coronavirus and the decision of many companies to work remotely, no meetings should be proactive.

We can negotiate contracts remotely, and in difficult moments by organizing tele / video conferences. Thanks to this, we operate much faster, we save time for ourselves and our business partner (while limiting CO2 by not traveling by car or plane).

A good contract is one, but good price monitoring based on negotiated terms often resulting from the price formula is the second. Daily price updates, reports from the market and from our purchasing portfolio give us a sense of control and control over the situation.

3. Make effective buying decisions, skip emotions.

"But the relief that I bought now for the next year, prices are increasing the next week ..." "Awful moment to buy! After a month of purchase, prices fell by another 5%! I will have a serious conversation with my boss. "

Let's look more broadly at the situation:

Energy procurement is like a long distance run, not a short sprint.

Keeping the budget and often the competitiveness of our business is at stake. Let's look at a broader perspective, not just a month or even a quarter. Let's analyze price changes in recent years and verify all purchasing models currently existing on the market. Buying too quickly, too late or not taking advantage of buying opportunities are common buying mistakes.

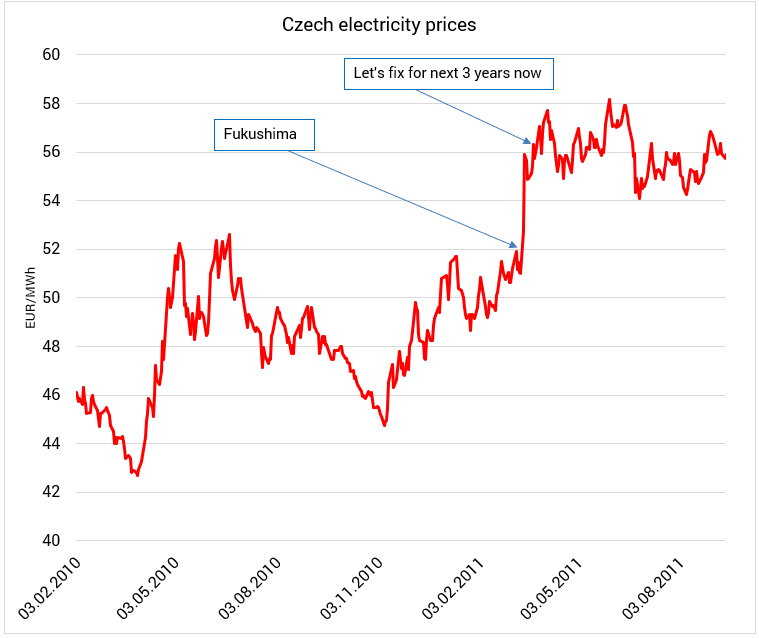

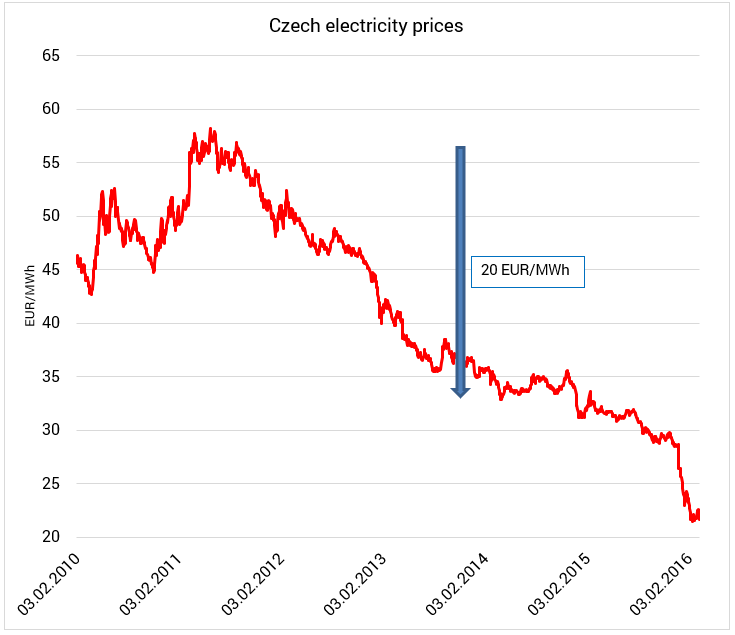

The decision made on the spur of the moment and for that time on the basis of a rational explanation about the closure of nuclear power plants in Germany:

SUMMARY

A lot has happened during the last ten years:

- Fukushima

- tensions in the Middle East

- Russia-Ukraine war

- nuclear reactor tests in France

These are just the most important events.

In the future, we will be surprised by subsequent crisis situations - it's more than certain. What we have is a story that teaches or should teach.

Therefore, it will be important to act efficiently in crisis situations and stick to the rules that tell us how we should act when we are dealing with both a good market situation and a crisis, and coronavirus in energy purchases will have smaller consequences for our companies.

Author: Bartosz Palusiński