Factors that will affect electricity and gas prices in 2023

Electricity and natural gas consumers will remember 2022 as one of the most difficult years in the history of running their businesses. Purchasing energy has never been as difficult as last year. What strategies to adopt for the rest of 2022, 2023 and beyond? Should we buy now or later and for what periods? using which energy procurement models? What tools should we use to try to predict price volatility? The question from last year is definitely still relevant this year.

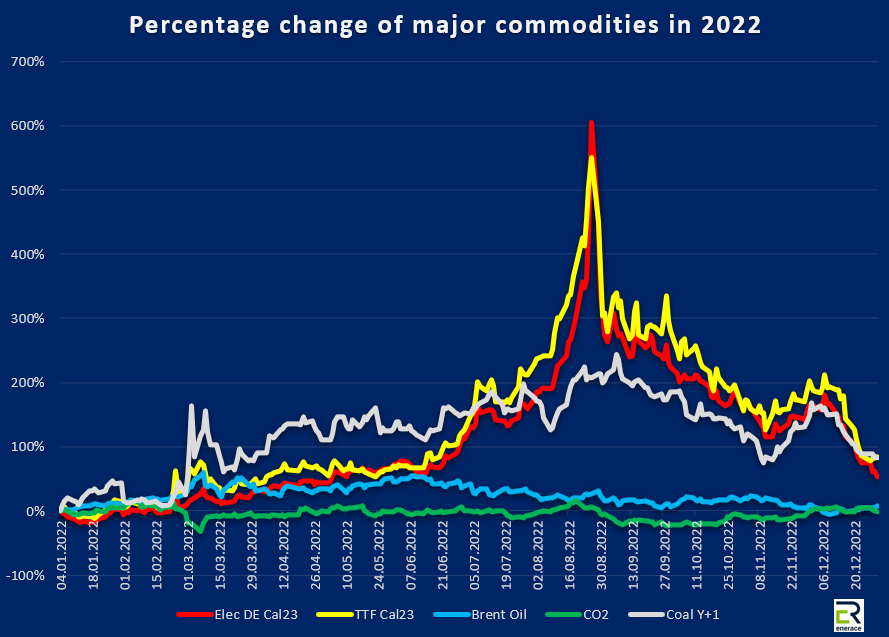

The chart below shows the percentage change in the most important market benchmarks in 2022. What will happen in 2023 and beyond?

Source: Enerace/ Refinitive

After the huge turmoil on the energy market last year, we have collected - in our opinion - the 8 most important factors that will affect electricity and gas prices in 2023 in Europe and in the world.

The government in Paris has drawn conclusions and is systematically bringing new nuclear units back to life. A huge corrosion repair program has been planned for 2023, which, when completed, is to ensure the production of electricity at the level of 330-330 TWh. At the moment, the French do not use 30% of the installed capacity. The situation is to change this year and thus give Europe a second wind in terms of electricity.

Let's remind…

France produces about 65% of electricity from nuclear units, which corresponds to about 350 TWh (in comparison, Poland uses about 170 TWh of electricity per year in total).

As you can see from the infographic below, throughout 2022, France faced a serious decline in generation from nuclear power plants. Shortages in generation reached almost 50-60%, so France had to replace up to 175-200 TWh of energy with generation in other sources/reduce consumption/or import from neighboring countries. Imports were therefore associated with higher generation of coal and gas sources to cover the capacity loss in France (impact on higher coal and gas prices, thus CO2 as well).

Source: Bloomberg

Last year was record-breaking in terms of LNG imports to Europe, which also turned out to be a savior and the main substitute for Russian gas. However, when thinking about LNG, it should be taken into account that until mid-2022 Europe was "taking" Russian gas and was able to fill its storage facilities using it. This year it will not be possible, because the Russian pipelines will not support Europe any longer. We will soon find out whether LNG will be able to cover the difference this year as well. This will be affected by the weather, demand in EU and from other directions or the pace of development of the LNG infrastructure in EU.

Gas inventory levels as of January 17, 2023 were still very high (over 80% in major storage facilities in Europe and over 95% in Poland), which was a very good result for gas prices.

Source: Enerace/ Refinitive

Continuing the topic of LNG, it is worth mentioning the informal fight between Europe and Asia over how much gas will flow to a given continent... and at what price. The number of gas carriers and suppliers is limited, and the direction in which LNG will flow largely depends on the price. If the Asians wake up and are more ‘greedy’ and thus willing to raise rates, the whole situation may have a pro-growth effect on prices.

Gas prices in the USA/Asia and Europe are presented in the graph below. As you can see, currently gas prices in Asia are higher than in Europe, so LNG exporters may be willing to change the direction of supplies from Europe to Asia. Less gas for Europe means potential higher gas prices in 2023.

Source: Enerace/ Refinitive

An important issue is also to increase the production of electricity from nuclear energy in Japan. More electricity from nuclear, less from gas -> lower Japanese demand for LNG. Let us remind you that Japan and China compete every year for the title of the largest importer of LNG in the world. Less LNG in Japan means a better chance for gas for Europe -> chances for a better prices.

The economic results in China, a country that is currently slowly waking up after the Covid lethargy (e.g. restrictions have been lifted), will be of great importance. If the giant returns to full capacity, we can expect an increased demand for gas and coal, and thus - a price fight. But is the condition of the Chinese economy good enough to return to the state before the pandemic? We'll see...

There is no denying that the economic situation in Europe and in the world is not the best at the moment. Most countries are struggling with record inflation, which is driven, among other things, by energy and fuel prices. Unfortunately, many analysts predict that the worst is ahead of us and only in 2023 we will feel its greatest effects. Lower demand for energy may result in lower prices.

The "Fit for 55" climate package, backed by the green transformation of EU countries, may have a significant impact on energy prices in the world. It all depends on how efficiently and quickly EU countries will implement changes locally and whether progress and care for energy security will win over bureaucracy.

On January 5, 2023, at 6:00 am, nearly 10 degrees Celsius was recorded in Poland. A mild winter this and next year will be of key importance for gas and electricity prices in Europe. This translates into the energy consumption and gas storage levels by individual EU countries. On the other hand, RES (sunshine and wind) is also important, which is to play the first fiddle in the European energy mix.

The prices of ‘black’ commodity will depend on many factors, such as the mining and export capabilities of countries in Africa or South America. I mean the social mood (in many countries there are strikes - in mines, in transport) and the situation at the importer. An example is Germany, which, despite a large import of coal, was unable to distribute it in the country due to the too low level of the Rhine. Importantly, China has resumed imports of Australian coal, which may raise concerns about price developments in the near future.

The economic recovery coming from Asia may significantly affect the prices of coal or gas in Europe. If China wakes up and increases demand, it will put pressure on gas and coal prices. On the other hand, high electricity and gas prices began to weigh heavily on customers in the second half of 2022 and 2023 will be no different, and even more difficult. Recession in Europe is a further potential decline in industries production and energy consumption -> a chance for a dropping electricity and gas prices. Therefore an important is how companies will adopt its energy procurement strategies for 2023 and beyond.

Author: Filip Pieńkowski, Consultant