Will Russia withstand the gas embargo? Expert: There is no alternative

Energy procurement is a much broader subject than many people think. It’s so complex that not even energy suppliers fully understand it. The realization of that fact was one of the key reasons why we started Enerace as a consulting company. We knew that there are hundreds of millions to be saved on energy each year, and we wanted to help companies keep that money in their pockets.

But there’s a limit to human capabilities. At some point, we decided that, with a proper software solution, enterprises could make purchase decisions much more efficiently even without our involvement. We wanted to turn consulting into a hands-off SaaS process.

Changing the way companies think about energy

Energy procurement has been a part of our professional life for the last 14 years. We’ve worked with dozens of companies during that time, and we can say that very few of them had any idea how much money they could save on energy yearly. For most people, energy cost is one of those things in business that they simply don’t give a second thought.

And we can’t say we blame anyone. Energy procurement is an insanely complex issue that, to be done well, requires a lot of knowledge, experience, and analysis. Most importantly, though, very few people even realize that there are many different (better, cheaper) options than their current ones.

Therefore, throughout the years, our main job was to educate, show why, how and when to buy energy. We’ve developed methods, analytic models and personally purchased thousands of GWh of energy for our clients. And, two years ago, we were ready to turn our know-how and experience into a scalable software solution for thousands of big clients to use without our assistance.

A simple platform that saves enterprises a massive chunk of their budget

We knew that the Enerace energy procurement platform had to be as user-friendly as possible. Its role was to collect data about prices, provide information about the energy market, and make simple suggestions on the best time to buy. Before we went looking for a software partner to develop our app, based on dozens discussions with our clients and its wishes we created a long and detailed list of crucial functions and features. Finally, with the requirements, we were ready to look for a software house. And that’s how we met Order Group, a team that still works on many improvements in our Enerace app.

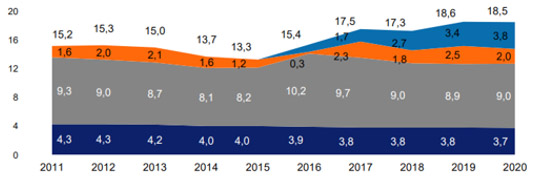

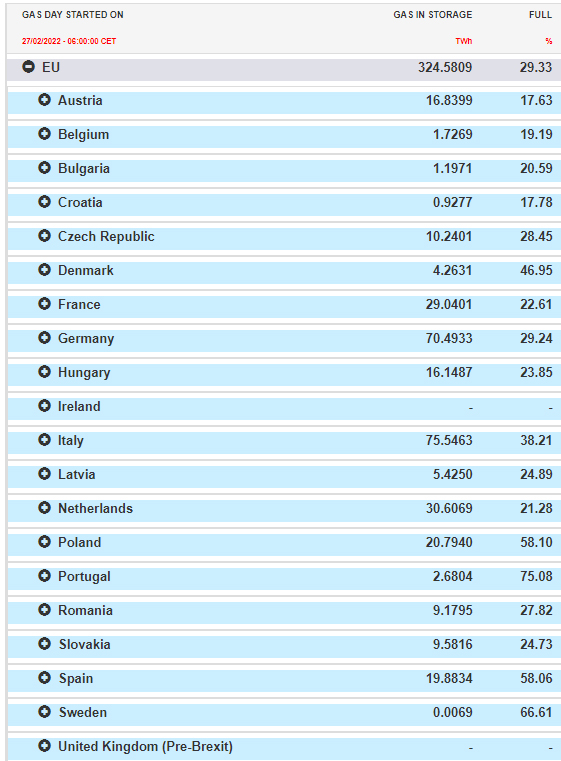

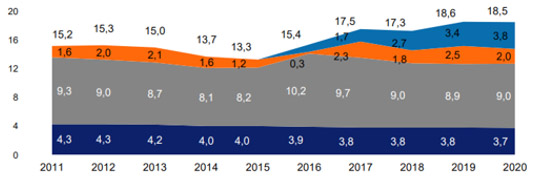

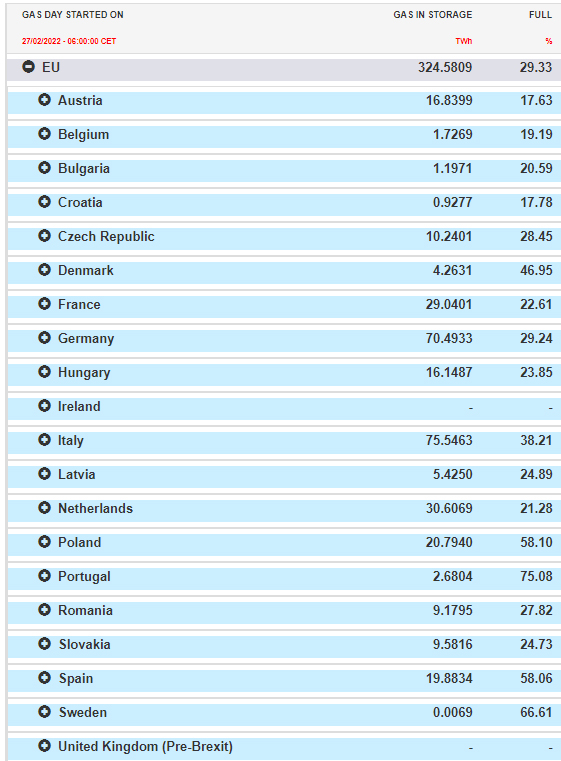

Source: State of natural gas storage facilities in Europe as of 02/27/2022, 6.00 am. GIE

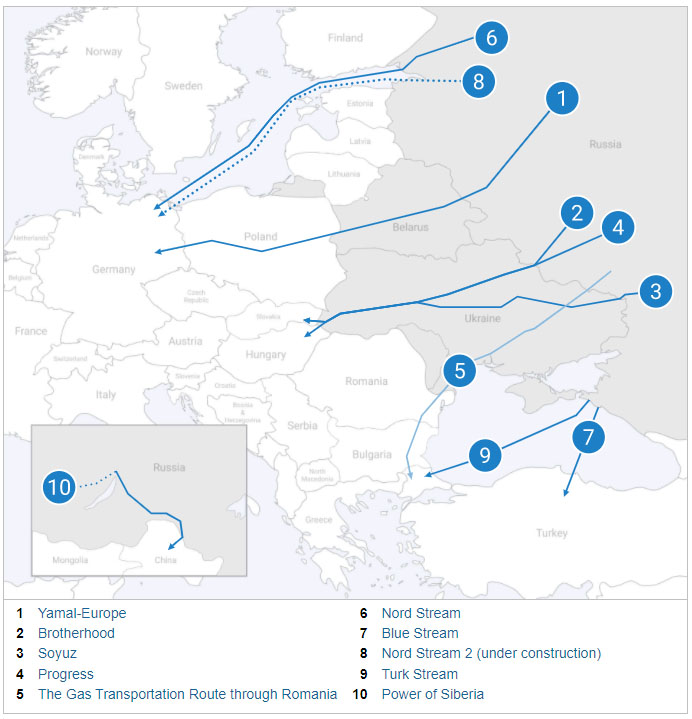

New gas projects: An invaluable opportunity for Poland?

New gas investments may be a chance for Poland to overcome the impasse. At the end of 2022, Poland should start operating a new connection with the Norwegian shelf - the Baltic Pipe gas pipeline (https://www.gaz-system.pl/fileadmin/pliki/przetargi/pl/Strefa_Dostyczki/Projekt_Baltic_Pipe.pdf), which is ultimately to have a throughput of 10 billion cubic meters. In addition, in 2016, an LNG terminal was launched in Świnoujście. It has a 5 billion cubic meters (currently, it is being expanded to 7.5 billion cubic meters). Therefore, it can be easily calculated that, theoretically, Poland should cope with it from the beginning of 2023 and will have an alternative to Russian blue fuel. Of course, the questions remain open - will the Baltic Pipe be considered one of those critical Polish projects completed on time, even ahead of schedule? And how quickly it will be possible to achieve the maximum capacity on this pipeline. PGNiG boasts of its gas deposits in the North Sea. In addition, shorter contracts with producers working on the Norwegian shelf should ensure Poland's stabilization of supplies.

Source: GIE

It's time to bet on LNG!

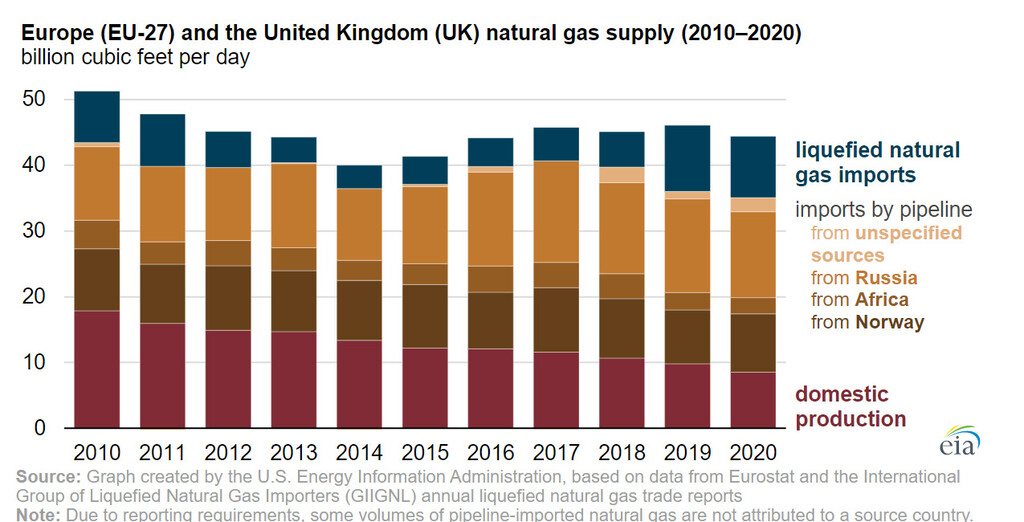

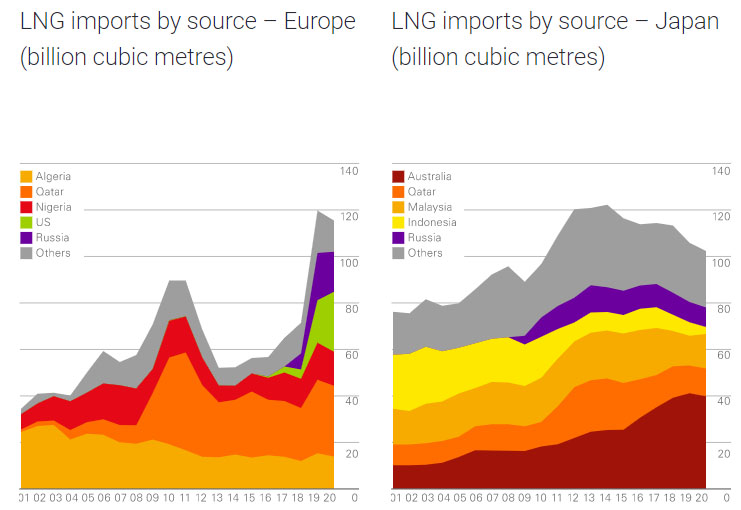

Following the shale gas boom in the United States from 2016, Europe has gained a critical business partner that has replaced import terminals with coal and export terminals with LNG.

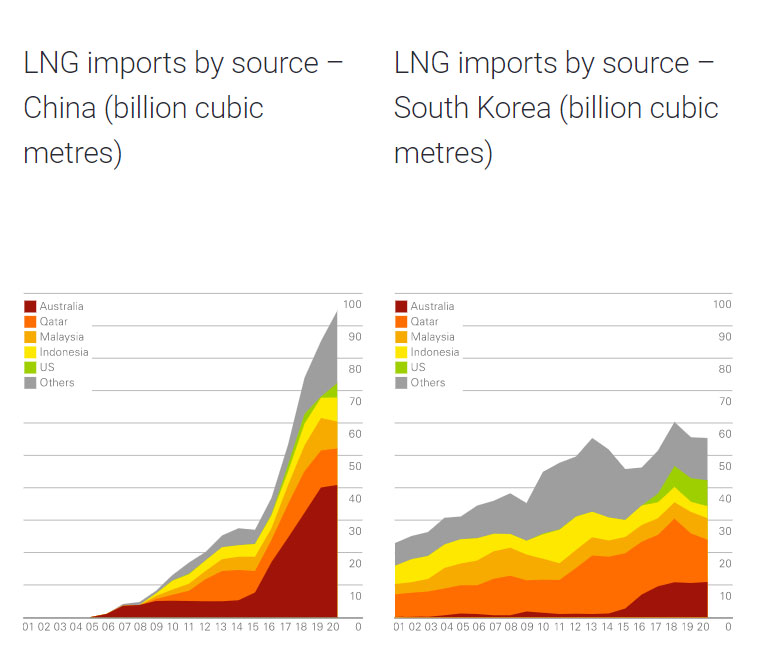

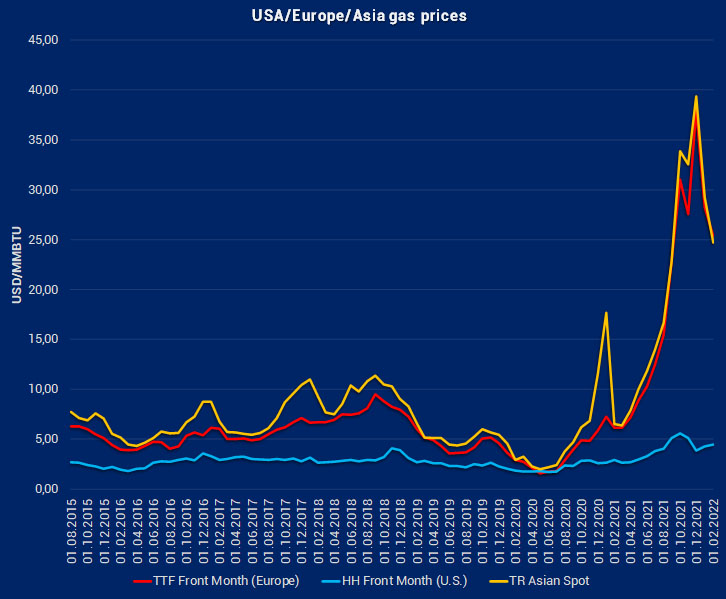

Unfortunately, the direction of LNG supplies depends on the economic calculation. Recently, we had to deal with a situation where gas-filled ships going to Asian ports, already in the Indian Ocean, decided to return to Europe - the selling price of gas on the Old Continent was much higher. However, we must bear in mind that LNG from the USA will not always flow to Europe in this dynamic market.

Source: bp.com

Let us remember that also at the beginning of 2021, when the winter in the Far East was severe, Europe had significant problems in obtaining LNG; especially at the time when Asia and Europe were to replenish stocks, and the gas crisis began: (more about this in the article: https://enerace.eu/en/a-path-towards-the-energy-crisis).

Climate change makes the seasons more unpredictable. Therefore, Europe and Asia can also compete for liquefied gas LNG in Q2 and Q3 2022, which will undoubtedly translate into higher gas prices for consumers.

Source: own study based on Reuters.

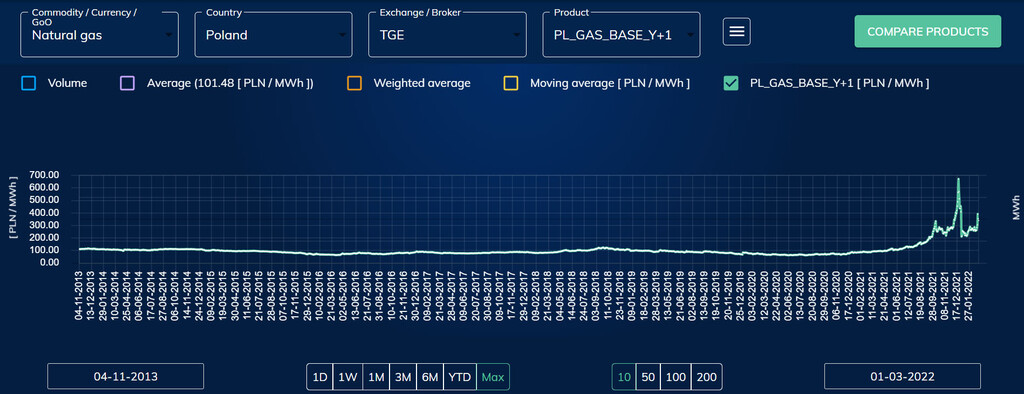

Russia's current aggression towards Ukraine opens an entirely unknown direction of price levels, primarily of energy commodities (and others), which, as we know and can see in the accounts in the last few months, are frighteningly high.

Source: Enerace.online

Will Germany bet on LNG and nuclear power?

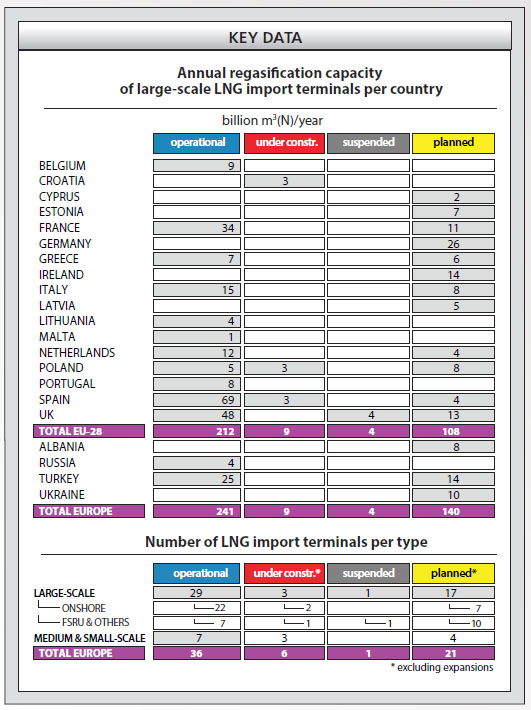

Germany is the largest importer of natural gas from Russia. In 2020, Germany imported over 45 billion cubic meters from Russia. Due to Russia's aggression towards Ukraine, Germany is accelerating work on two LNG terminals. Currently, Germany does not have any terminals for receiving liquefied gas by sea.

Currently, there are 36 LNG terminals in operation in Europe, and there are plans for another 21.

Source: GIE

Will Germany go back to the nuclear power plant? This hypothesis is much more probable today than a few months ago. E.on Group, one of the owners of nuclear power plants, is ready to restart its operation. Currently, the last three nuclear reactors are in process in Germany. After the Fukushima disaster in 2011, pressure from the Greens and the elections to the German parliament, after which the party found itself in the government, Germany set itself the goal of shutting down all nuclear units by the end of 2022. This goal was successively pursued.

However, in the face of possible shortages of natural gas, there is a good chance that this essential economy for Europe will change its mind to ensure continuity in electricity supply to companies in this country. An additional impulse may come from French President Emmanuel Macron has announced the construction of 14 new nuclear reactors in France by 2050.

What awaits entrepreneurs and gas buyers soon?

Will Europe rebuild its sources of supply of strategic energy resources, and when can this happen? This is an issue that requires much political agreement. Our direct influence on shaping energy policy is quite limited. Of course, as entrepreneurs, we can act through various industry and lobbying organizations. However, the energy policy of the individual Member States and the European Union itself will depend directly on the actions of politicians.

As entrepreneurs, we should instead focus on what we directly influence.

It is worth recalling a few basic issues that we should consider when buying energy:

1. First, don't panic or make hasty and quick decisions out of your emotions.

2. Contractual situation. Do you know your contractual situation well? Do you have a contract to purchase electricity and gas for the next quarters of 2022 or 2023, 2024 and 2025?

If so, go to the next step. If not - ask the sellers for an offer for a tranche agreement for subsequent periods. Do not necessarily secure your prices immediately. However, having a tranche purchase agreement will allow you to react quickly if the situation requires it.

3. Analyze. Evaluate the facts, beware of rumors, opinions, and especially: false information.

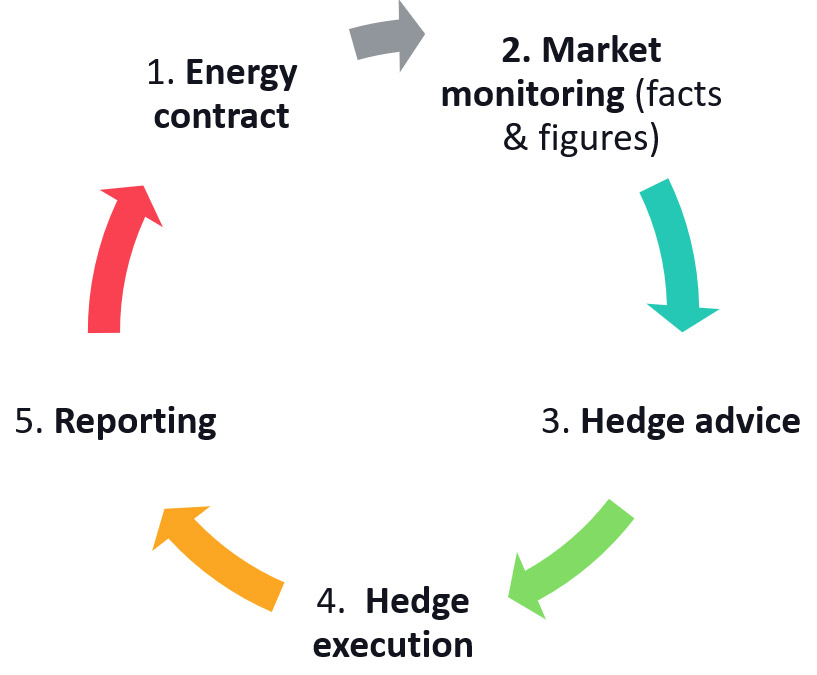

4. Agree on the operating model in your own company. Involve the right people and assign responsibilities. Start with something simple like this: