11 examples of how not to buy energy

When working with clients, we encounter various problems and doubts that may involve the purchase of energy. Based on our experience, we have prepared the 11 most common issues along with the proposal to solve them. We encourage you to read and discuss.

1. With current legislative turmoil, purchasing energy for the coming years is completely useless.

For several months, the Polish energy market has undergone a specific legislative tornado. Proposals for amendments to the Act may be considered as undermining the credibility and the Polish Power Exchange as well as the foundations of the entire energy market in Poland. There was a big question mark about the functioning of the seller's market as well as the end-user market. Does the Act, however, affect all recipients?

It turns out that the recipient who made the purchase in the second half of 2018 for 2019 receives support from the government due to a significant increase in energy prices year on year. There are many questions and doubts. However, let's focus on one essential: if all users have that problem and why other end-users did not buy earlier when prices on the market were low? The answers can be multiplied again (more on this later in the article).

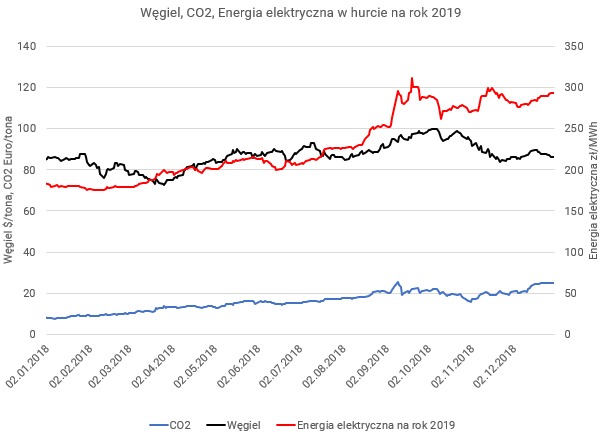

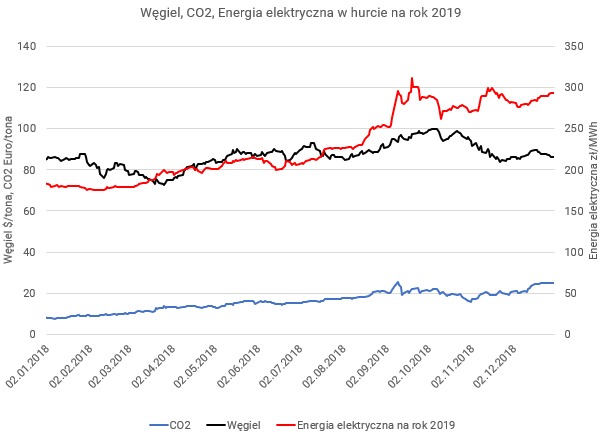

Actually, many end consumers have set the price for 2019 much earlier and current legislative mess does not harm them at all. Buying earlier? Again, there will be statements like "who knew it", "we do not have a glass ball", "easy to analyse backwards", "definitely they don’t have it, the devil is in the details" etc. Unfortunately (or fortunately) it is true. Long-term view of the competitiveness of my company forces the management of costs in a wider horizon. Finding solutions to reduce the risk of possible price fluctuations is crucial. Remember that energy prices are not shaped by the government, politicians or just large players. Changes in energy prices are mainly due to fundamental factors. In the case of Poland, it is mainly the price of coal and CO2. In 2018, coal and CO2 prices had a major impact on the rising energy price. So, should not we look for "culprit" somewhere else?

What to do?

Develop right now a good long term strategy and negotiate contracts that will allow you a flexible hedging approach so a quick reaction on increases and decreases on the market. Do not wait for any further government support for energy prices for 2020, if the global economy accelerated and raw materials were expensive, that could affect energy prices for 2020 and subsequent years.

2. I always negotiate at the end of the year, because then prices are the lowest.

This is a situation that we encountered very often until the end of 2017.

Let's see what the facts were:

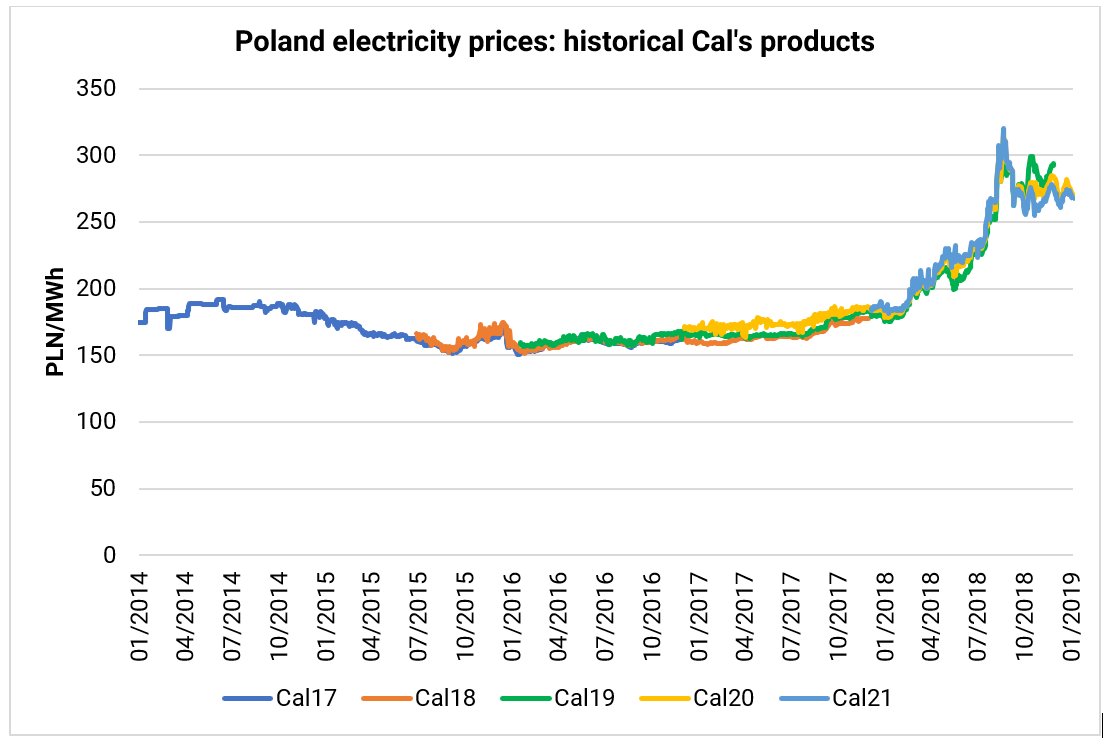

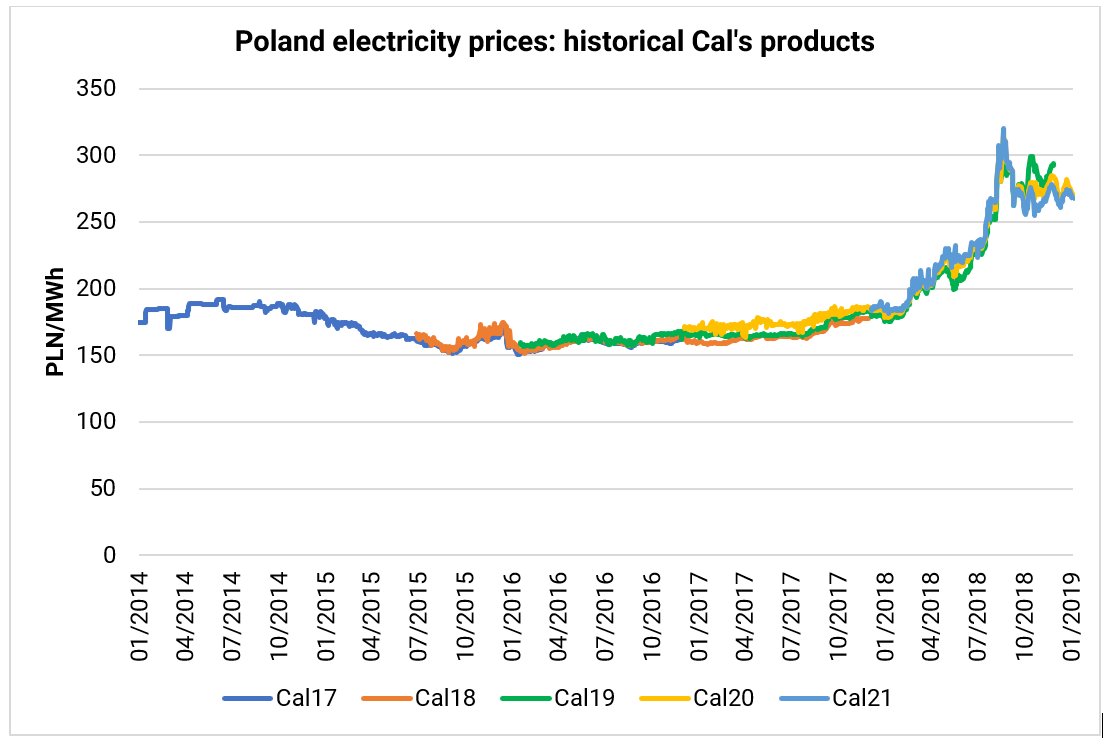

The above chart presents quotations for forward contracts for deliveries in 2017, 2018, 2019, 2020 and 2021 over the period 2014-2019. As you can see, many people tried to enchant the reality in this way, claiming that at the end of the year we have some inexplicable coincidence the lowest prices. This prophecy sometimes works. It is difficult to recognize this as regularity. Especially in the context of the last two years, it has completely escaped from this framework.

It should also be noted that supporters of similar regularities in other periods of the year are not lacking. There are people who think that the best is the first quarter, others consider the holiday period the best time.

Unfortunately, such assumptions very often block companies from making the right decisions at the right time. Being attached to such claims, we take a chance to capture better hedging moments or, what's worse, deliberately expose ourselves to significant losses when the prices go up, as was the case in 2018.

What to do?

Negotiate according to your long-term energy procurement strategy. If your strategy defines a 2-year contractual horizon, make sure you always have a contract with an energy or gas supplier for 2 years ahead. Besides, if from a historical point of view prices are at a very low level, think about extending this horizon for another year.

3. I am interested only in a fixed price, because I need to know what the budget for the next year will be.

This is a very typical requirement of many organizations. In particular, this applies to public entities that perform tenders based on the assumptions of the Public Procurement Act.

Also, many companies make the mistake in the name of this rule, which can lead to excessive expenses just because they want to have a specific budget value.

What to do?

Here again, we refer to the long-term strategy. As a rule, the requirement to know a particular value is not bad. Let's try to reformulate this condition a bit: what maximum price we will be able to accept? It still does not mean that the budget should be completely consumed. It can be just the worst scenario. Thanks to this formula, we will be able to observe what is happening on the wholesale market, make the necessary calculations and check whether we should secure the next tranche or we will be able to wait.

In addition, by implementing a long-term strategy, including having a contract with a supplier for 2 or even 3 years ahead, we will be able to control and determine prices and costs in the long term much more quickly and accurately.

4. I’m in a purchasing group, because of the large volume we negotiate a low price.

In private held companies, this argument is fortunately happening much less frequently than a few years ago. Purchasing groups peaked in popularity in Poland in 2013 and 2014. Very spectacular "successes" of such activities could be observed especially in the middle of 2013, when wholesale electricity prices in the annual contract on the Polish Power Exchange reached the historic bottom dropping to the level of 145 PLN/MWh.

A large volume as a guarantee of a low price is another myth, with which we discuss during many meetings with clients.

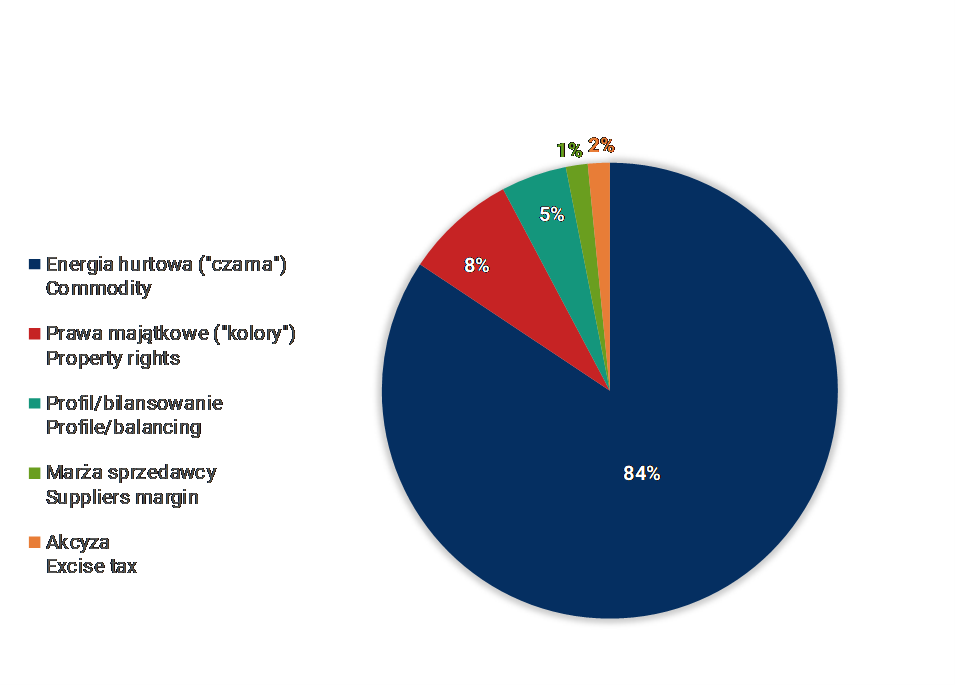

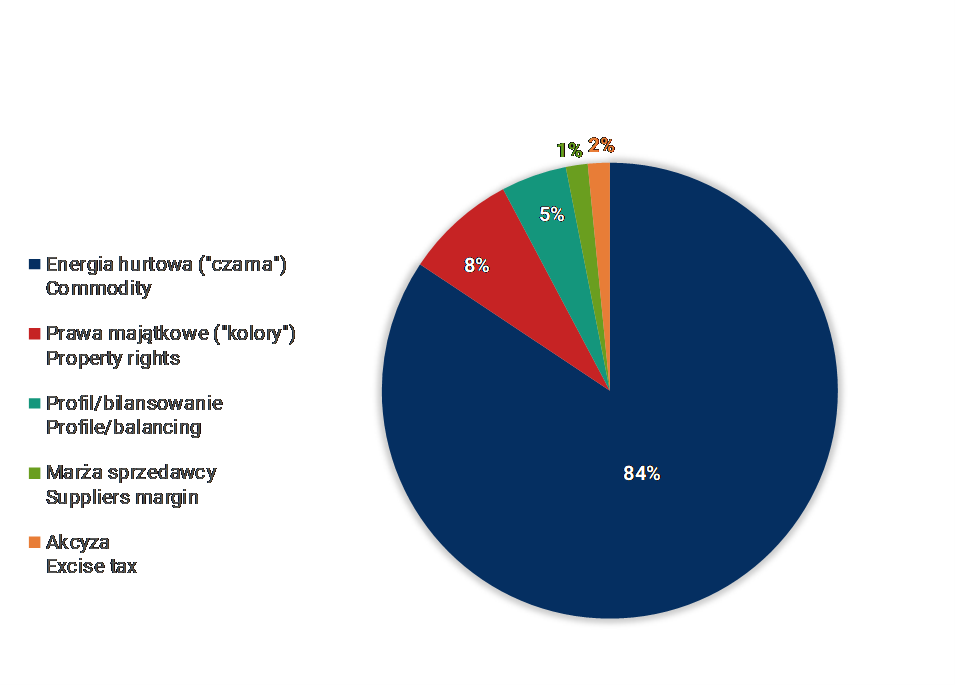

In order to refute this theory, we first present the basic components of the energy price. They are estimates prepared on the basis of current data:

As you can see, the main component of the electricity price is a wholesale price. We have already presented wholesale prices above and we know that they can range up to several dozen zlotys up and down.

Can the wholesale price that we can observe on a daily basis at TGE be different for the 10.000 MWh and 100.000 MWh volumes?

The element that we would like to pay attention by analysing the offer of the purchasing group is the profile/balancing cost (according to our estimates, it is about 5% of the energy price). Entering the purchasing group, not only the volume will be combined but, above all, the profiles of energy consumption. Each company has its own energy consumption profile. Some companies due to the characteristics of work in a given industry consume more during the day, others regardless of the time of day or night have a balanced consumption profile. Some industries are able to consume energy primarily at night and off peak hours.

The last group of consumers can therefore take into account the most advantageous profile valuation, because in their hours of the highest consumption energy price is the cheapest.

The purchasing group combines companies with different consumption profiles. How do suppliers evaluate such a profile in this case? They usually make averaging for all potential group participants. So companies with a better profile will be harmed by the inferior profile of the others and vice versa those with a worse profile will gain something thanks to those who consume energy in off-peak hours.

In addition, we often share conditions with ... competitors that also can use the same offer. Do we want to have the same approach and conditions as our competition?

Based on our experience, we can also confirm that the yearly volume, which can benefit on joining the purchasing group, is around 5.000 MWh per year.

What to do?

Check with whom you connect in the purchasing group and calculate whether it is actually a more advantageous offer than individual terms presented by energy supplier. In addition, check also the flexibility of this solution, e.g. what will happen by falling prices on the wholesale market. It is important to compare offers prepared at the same time. Wholesale prices, as we have already shown above, can significantly fluctuate over several days. Let's also not forget about counting the costs of participation in the purchasing group.

5. The tender in our company is subject to procedures and will take a lot of time.

We have already discussed the lack of resources in the company on #4 example. Our observations show that by striving for the standardization of processes in companies, there is sometimes a distortion of priorities. The procedures are designed to meet the compliance requirements, and not to support the main objective, which should be ensuring adequate resources for the functioning of the company. An extreme example of how this should not work is the situation of last year in the public sector in Poland. Some public entities after the tender fulfilling the terms of the Public Procurement Act, did not accept bids because of too high a price in relation to the budget. They deliberately led to the introduction of reserve supply in order not to expose themselves to a choice not in accordance with the procedure. Reserve prices resulting from the tariff are even three times higher than market prices. All this in the name of procedures. Does it really make sense?

To find the answer again, I refer to the energy price breakdown. If in subsequent rounds of the tender procedure we negotiate a margin reduction of 10% in relation to the initial level (e.g. 1,2 PLN/MWh) and at the same time the wholesale price will increase by 10% (e.g. 26 PLN/MWh), then we should have a feeling of a well-fulfilled task?

I think that a simple calculation will show us an unambiguous answer.

What to do?

If the procedures lead to a bigger risk, then we should be the ambassador of the change and change the rules in the organization. If the resources in the company are so limited that it is difficult for us to carry out our work with respect for them, let's look for support outside of the organization. Often, the outlook from third party outside influences the changes within the organization.

6. We have long-term cooperation with our existing supplier and we always give him the last chance. Only for us, our supplier always has prices that no one else has. Our supplier always depends on us and makes special concessions to keep us, because our company pays very well.

We appreciate long-term and partner relationships with suppliers. We also believe that your business in many respects can be unique and prestigious for your business partners. However, don’t believe in the wonderful price solutions on the energy market, prepared especially for us. Once again, we will return to the energy price components (see graphic under #4 above).

The most important element (in other European contracts as well) is the wholesale price, which is very often based on quotations on the TGE. The seller's margin is limited, on the basis of current estimates, to the level of 1%, thus how is it possible for the seller to reduce the price for you unconventionally? Why would he sell you goods at a price below the applicable market realities? What could be the space for supplier to improve margin which is normally at a level of a few zlotys per MWh?

If the situation is really there:

let's check if we are really comparing prices including all components,let's observe how the wholesale market changed since the first offer was made and if our offer is still validlet’s make sure that our supplier does not assume speculation, expecting that the price on the wholesale market will fall,let’s also check the non-price conditions that may affect the risk of cooperation with a given supplier.

What to do?

It is a good practice to regularly check that our energy supplier is still offering us the best conditions. If the offer of the current seller does not allow us to implement the key points from our long-term strategy, let’s not be afraid to change the supplier. When do you compare offers, always make sure you compare apple to an apple.

7. I will wait with the price hedging, because something tells me that prices will go down and I do not want to overpay.

Some people have an natural tendency to take more risks than necessary. Once they become familiar with buying tranches they start to treat the tranche model contract as a financial instrument to improve the company's results. Similar mechanism was used last year by some smaller energy suppliers in Poland. We will not mention the names of specific companies, but probably most of us interested in news about the energy market have received press releases about the financial problems of several suppliers. These types of activities most often result in very serious consequences and financial problems. The price of energy, which we determine based on the tranche contract, from the company's point of view is not a financial instrument that we should play with. As we have already mentioned, the tranche contract is a tool that helps us reduce the risk and not expose us to even greater one.

What will happen when we start to play and the prices instead of falling will skyrocket and we will lose a competitive position on the market or, worse, we will lose liquidity in our P&L?

What to do?

When discussing a long-term energy procurement strategy, let’s define the risk limits which correspond with the profile of our companyThis will allow you to limit speculative mechanisms and decisions and respond appropriately earlier, before it can be too late.

8. We will not deal now with price fixing for 2 or 3 years, because it is a very long perspective. And by the way I do not have time for that.

We have seen this problem quite often in recent years. While there is a long-term decline in wholesale prices, the issue of limited resources to choose a seller gives a false comfort feeling. On the other hand, having a contract with a fixed, pre-determined price for the next 2 or 3 years is also a significant risk. If prices dropped and we did not have a mechanism to adjust the price to the current situation, then it may turn out that our competition will have a much better level of energy prices. It can be a significant weakness of our offer in a competitive market in our industry.

Let's go back to facts and wholesale prices for a moment to answer the question of whether we can afford not to have a contract for 2 years ahead.

I will use the example of a company that consumes 10.000 MWh of electricity per year. Our example company negotiated the agreement only for 2019 in January 2018. However, it did not take the decision to conclude the agreement for 2020 at the same time.

In January 2018, the wholesale price for the year 2020 fluctuated around 183 PLN/MWh. During the last twelve months, prices reached the level of even 290 and then they fell to the current level of PLN 256 / MWh.

Over the last 12 months, the difference in the wholesale price is about 73 PLN/MWh.

Therefore, the lost opportunity in the whole year is: 73 PLN/MWh x 10.000 MWh = 730.000 PLN.

Is it worth not to have resources and strategy to potentially increase the yearly energy cost by about 700.000 PLN?

What to do?

We suggest to change the perception of an energy contract as a goal. Imagine that the contract with the supplier is a tool by which we have a real impact on shaping our costs and achieving the financial results of our company. The tranche contract, because we have such in mind, will help you react to the dynamically changing wholesale prices. Consequently, possible fluctuations in the energy budget can be limited. Of course, the risk will always exist. However, you can try to effectively counteract on this.

If you do not have the resources to engage temporarily in monitoring the market, to respond in a timely manner to hedge prices, we offer external support. The costs of external advisory are disproportionately lower compared to the real example given for 2020.

9. Hedging in our company is not an option at all, because I have to get approval from my boss, the boss of my boss and the finance director. And sometimes I still need to get confirmation from the manager of this cost category at the international level.

This phenomenon we observed by some clients, where due to the size of the business, organizational structures are very complex. Moreover quite often we have to deal with a strong hierarchy, where making a significant financial decision requires the approval of at least a few people.

Let's go back to example #8, where we calculated the lost opportunity resulting from the wrong moment to hedge the price. Time is money! This statement by Benjamin Franklin is very valid in the case of securing energy prices.

What to do?

If the procedures in your company expose you to the possibility of losing the opportunity, then we encourage you to change them again! We know that sometimes it is difficult. However, when the leader of this change is someone who is outside from our organization it is easier to change it. Do not be afraid to suggest changes just because it can be difficult.

10. Tranche model is probably more expensive. The supplier has a higher margin for such contracts.

With these doubts, we often deal at the beginning of cooperation with many clients.

If you are concerned that switching to a tranche contract may involve higher costs, then we suggest you check it out. Knowing the energy price structure and individual supplier, we can calculate it.

In the vast majority of cases, when we compare this data to our clients, we get the similar results.

What to do?

During the organization of the energy, let’s gather fixed price offers and formula price offers and compare them.

11. We have unadjusted measurement systems to the Third Party Access (TPA) principle and we cannot change the supplier. That is why we always negotiate a fixed price for the next year with our current supplier.

Lack of adjustment of measurement systems is a quite significant limitation. If we compare different offers and find out that our current supplier doesn’t offer the best conditions for us, we will have to cooperate with him anyway. This also means that it will not be possible to change the supplier until you have adapted the systems to the TPA rule. Often the adjustment cost is around several dozen thousand zlotys.

Is it worth to postpone this one-off investment? In our opinion, long-term thinking, it is not worth to wait with that, taking into account the potential benefits of fully using the free market. However, appropriate calculations should be made taking into account the consumption as well as potential price changes on the market.

What to do?

Let's plan this one-time investment, despite having to spend even tens of thousands of zlotys for this purpose. Alone the opportunity to change the supplier gives us a much better negotiating position and we prepare a business plan that defines the return on investment.

In addition, even when our measurement systems are not adjusted, we can always ask our current supplier about the price proposal based on the formula. Thanks to that perhaps we will be able to do the risk management without necessity to change supplier and adjust the meters

___________________________________________________________________________________________

The above-mentioned 11 situations are just an outline of the problematic issues that we face in our work related to the optimization of energy costs in various companies. At the same time, we emphasize that buying based on the Energy Exchange indexes is not the only options to optimize the cost of energy in the long term.

We encourage you to discuss and leave your comments!

Author: Wojciech Nowotnik

Interested in energy market analysis? Order free subscription of our reports!